Section 1202 allows stockholders of a corporation to claim an exemption from federal income tax for a minimum of $10 million of eligible gain realized on the sale of their “qualified small business stock” (or “QSBS”).

The rules governing the QSBS exemption are complex but extremely important for founders and business owners in Florida to understand. With this exemption, taxpayers can avoid paying income tax on some or all of the appreciation on their stock, so it’s important to understand these considerations even at the point of formation (as will be demonstrated below).

How does a taxpayer determine whether they are eligible for these benefits? This is a short outline of six key requirements that should be carefully considered in determining whether QSBS benefits might be available.

-

The stock must have been held for more than five years. For this purpose, certain “tacking” rules can apply. For instance, anyone who acquires stock as a gift or by inheritance can “tack” the holding period of the original holder onto their own holding period. A holding period can also be tacked if such stock is distributed to a partner of a partnership.

-

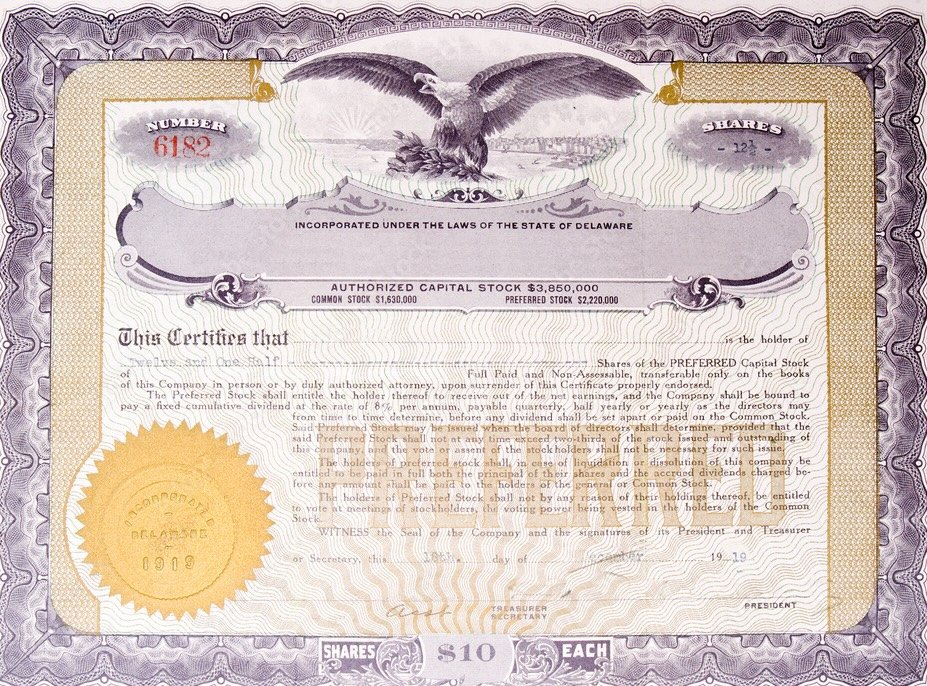

The issuer of the stock must be a domestic C corporation for U.S. tax purposes. The corporation can be formed in Florida or any other state. Stock of an “S corporation” does not qualify. In addition, interests in limited liability companies or partnerships do not qualify unless they have elected to be treated as corporations for U.S. tax purposes.

-

The stock must be acquired at “original issue” in exchange for money or property or as compensation for services. Note that this does not mean that the stock must be acquired at formation, only that it must be acquired from the corporation itself (and not another stockholder) in exchange for property or services. However, the other requirements of QSBS eligibility must also be satisfied.

-

At the time of issuance, the cash and adjusted bases of the property of the issuer must be $50,000,000 or less. Note that the assets of the subsidiaries may count for these purposes.

-

The issuer must use at least 80% of its assets in a qualified trade or business. Generally, “service” businesses that depend on the reputation or skill of its employees do not qualify (e.g., law, accounting or medicine). However, there is a lot of nuance to this requirement, and each business must be reviewed on a case by case basis with a qualified advisor.

-

Generally, any redemptions or repurchases of stock can raise issues for QSBS eligibility. In particular, QSBS eligibility can be lost if (i) during the 4-year period beginning 2 years prior to the date of issuance, the corporation redeems stock of the taxpayer or (ii) during the 2-year period beginning 1 year prior to issuance, more than 5% of the stock of the corporation (by value is redeemed).

This description is just a very basic overview of the requirements for QSBS eligibility. Taxpayers should seek advice from a qualified tax attorney to understand their eligibility for QSBS benefits.